Betting On The Blockchain: A Look At The Polymarket Decentralized Gambling Platform

Though volume on blockchain betting exchanges is still relatively small compared to centralized counterparts like FanDuel or DraftKings, on-chain exchanges allow for significantly more transparent historical odds/betting data compared to what traditional off-chain gambling venues allow for.

In this post we use decoded smart contract data from Luabase to take a look at Polymarket, one of the largest decentralized prediction markets built on Ethereum's Polygon Layer 2 chain. Launched in fall of 2020, Polymarket has quickly become one of the most popular blockchain betting exchanges by volume (millions of USDC bets placed monthly) and offers a wide range of markets to bet on from sports to election outcomes. Using a combination of on and off chain data, we will examine the following topics as they relate to Polymarket:

- Overview and historical betting volumes

- Largest all time payouts on the platform (spoiler: it pays to bet on politics)

- Largest long-shot wins on the platform: YOLO bets (low probability bets) that ultimately paid off

- Potential arbitrage opportunities: for certain markets, odds on Polymarket can significantly differ from traditional oddsmakers' odds which makes for potential betting arbitrage opportunities

Before we dive in, note that the data used in this post is available in a public Luabase notebook linked at the end. With that said, let's get into it!

Polymarket Overview

Markets on Polymarket resolve in the following ways:

- Binary - A market with two options that will resolve either $1 or $0. (ex: Will Tetranode have over 100k Twitter followers by 12/31/2025? YES/NO)

- Categorical - A market with multiple options that will resolve either $1 or $0. (ex: What ice cream will have most sales in 2025? Chocolate/Vanilla/Other)

- Scalar - A market that resolves to where the final value sits between a lower and upper bound. (ex: What will the population of Spain be in their upcoming census (47M-55M)? If the population is 50M, outcomes resolve to Long = $0.375 & Short = $0.625. If =< 47M outcomes resolve to Long = $0 & Short = $1. If >= 55M outcomes resolve to Long = $1 & Short = $0.)

During a market's open period, shares on each side of a bet trade between $0 - $1 corresponding to the probability that the outcome resolves in favor of a particular bet. For example, a market for whether the Tampa Bay Buccaneers will win the Super Bowl in 2023 will have shares of Yes and No trading between $0 - $1 up until the actual outcome is resolved. Because Polymarket doesn't have centralized bookmakers and the shares can be openly traded between bettors, share prices are set by the market.

If a bettor believes that the Bucs will win with 90% chance and shares for the Bucs are trading at $0.50, they should make that purchase. Once a market is resolved, the winning side can redeem their shares for $1 each and profit the difference between what the shares were bought for and the redemption price. Shares can also be sold prior to a resolution to lock in profits, cut losses, or act as a hedge.

Polymarket leverages UMA as an oracle to resolve markets in a decentralized way while betting shares are denominated in USDC on the Polygon network.

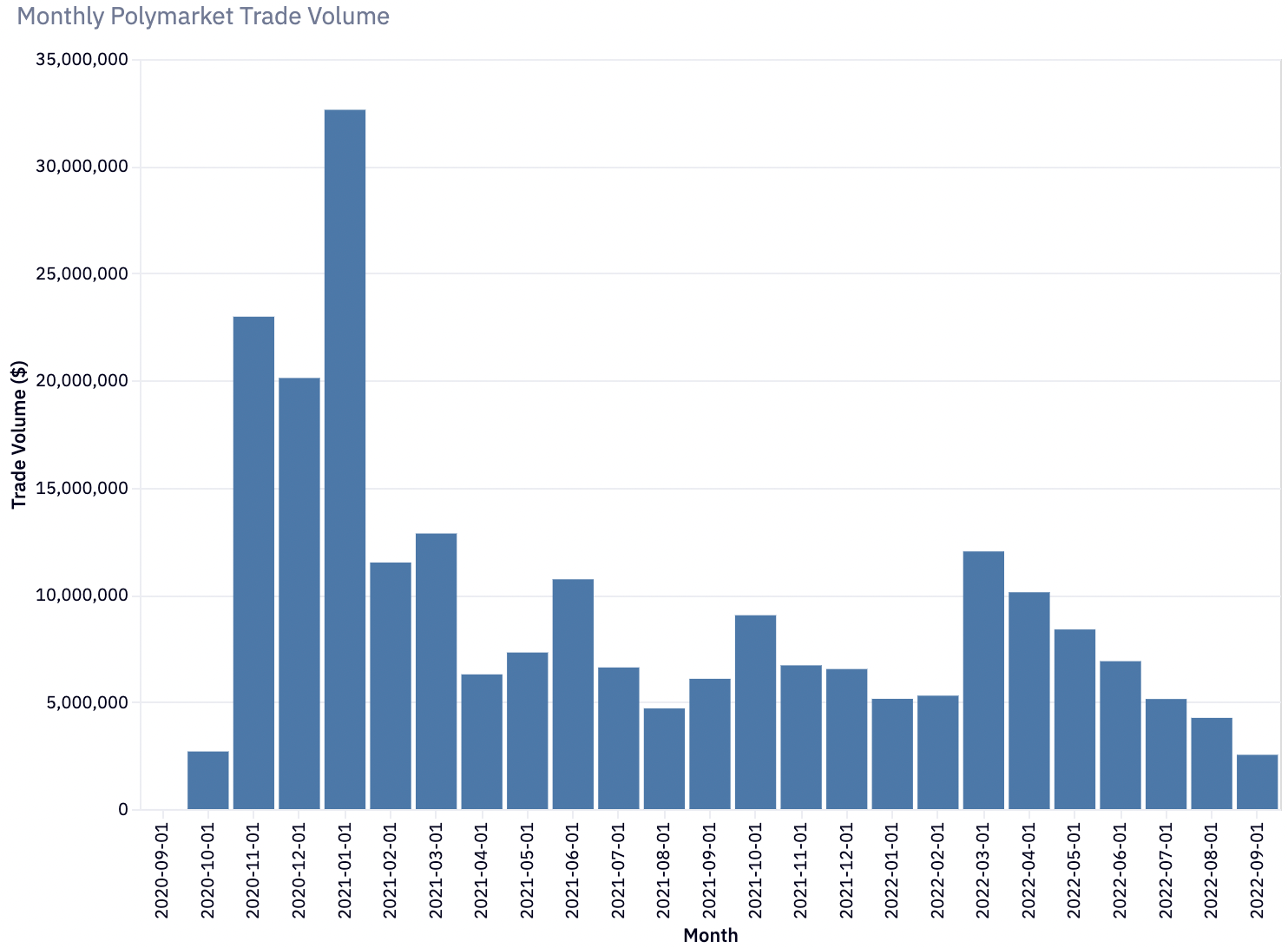

The chart below shows Polymarket's monthly trade volume since launch:

As shown above, Polymarket sees millions of dollars in transaction volume almost every month.

Largest All-Time Payouts

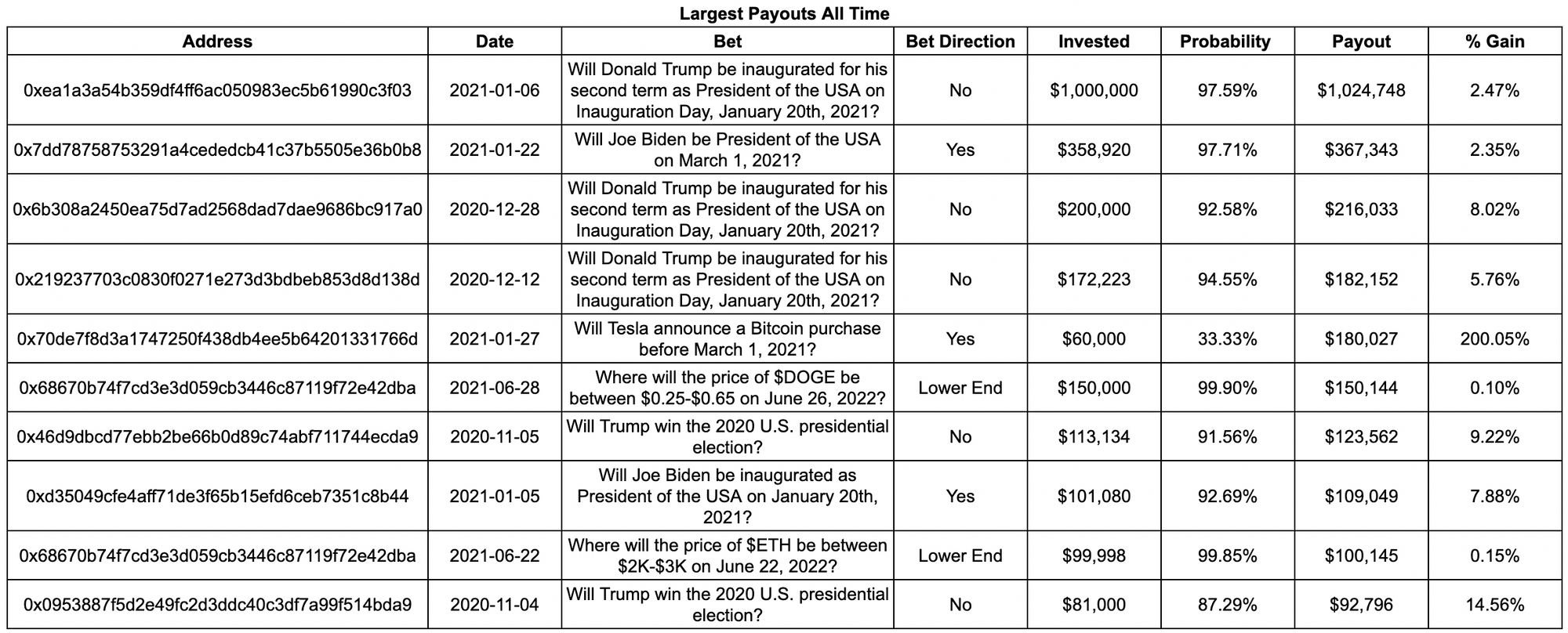

The chart below shows the top 10 largest all time payouts on Polymarket and what the markets/bets were on:

The bet with the largest all time payout of $1,024,748 was also the largest amount ever risked on the platform with a $1 million bet that Donald Trump would not be inaugurated on January 20, 2021. Interestingly, 7 out of the top 10 highest payouts were related to the 2020 presidential election. Looking at the previous graph of trading volume, we can see that the peak in volume during October 2020 - January 2021 was likely driven by bets related to the presidential election and subsequent inauguration.

Largest Long-Shot Payouts

Everyone likes an underdog story, especially if it makes them a lot of money. In a now infamous bet from 2002, NBA star Charles Barkley picked the New England Patriots to win the Super Bowl over the St.Louis Rams at a roughly 38.5% implied probability of winning. His initial $500K investment netted him $800K in winnings after the Patriots won the Super Bowl that year.

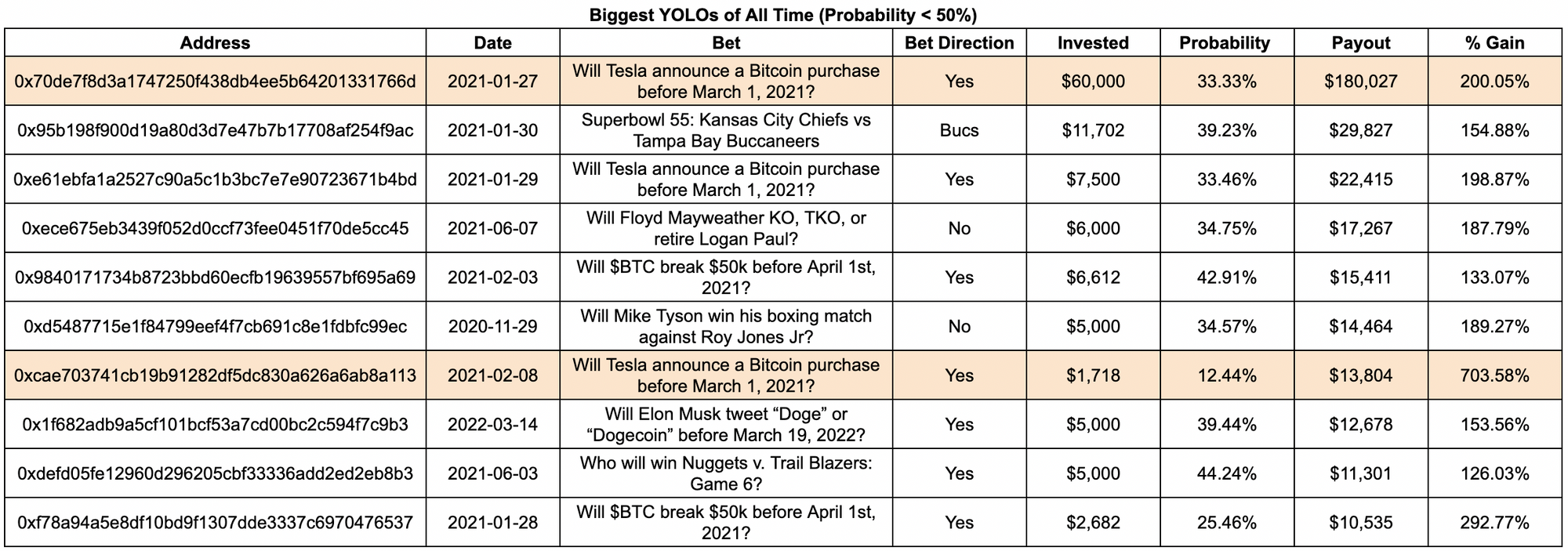

Taking inspiration from Charles Barkley, we pulled the largest Polymarket wins for bets with < 50% implied probability of winning:

As seen above, the biggest long-shot win of all time was on "Will Tesla announce a Bitcoin purchase before March 1, 2021?", with winnings of $180K on a risked amount of $60K (implied probability of 33%).

Interestingly, the largest percentage gain of all time was on the same market and bet but made a week and a half later (second highlighted row above). A bettor bet $1718 to win $13,804 at an implied probability of 12.44% for an overall gain of 704%.

Polymarket: Arbitrage Betting

Opportunities for arbitrage betting occur when odds for the same bet differ across bookmakers. Amongst traditional bookmakers, odds across books are usually close and the favorites to win are almost always the same. However on Polymarket, large deviations in odds are more common. This is for several reasons:

- Polymarket is a relatively new exchange with a higher barrier to entry compared to platforms like Fanduel or DraftKings (users must acquire crypto and figure out how to deposit into Polymarket). Because of this, trading volumes for certain bets on the platform are small and can lead to inefficient markets

- After a recent settlement with the CFTC, Polymarket is no longer open to customers based in the US. Customers can still get around this by using a VPN but this further increases the complexity to join the platform

- Polymarket has no central bookmaker looking to take a cut in the way FanDuel might. There is a small fee on each trade that goes to the oracles and liquidity providers but this fee is small relative to what a centralized bookmaker might take, allowing Polymarket markets more flexibility in the price discovery process

Some recent occurrences of Polymarket odds deviations are discussed below:

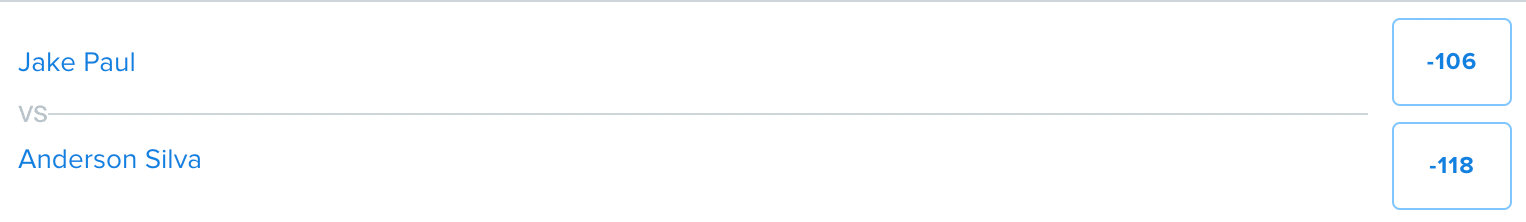

Boxing: Jake Paul vs Anderson Silva

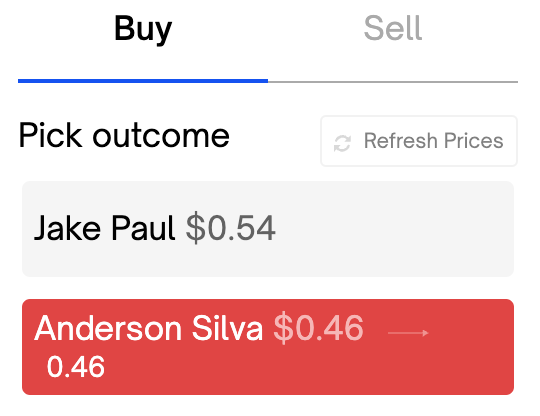

Polymarket:

- Favorite to win: Jake Paul

- Implied probability of Anderson Silva to win: 46%

- Bet $100 on Anderson Silva to win $117

FanDuel:

- Favorite to win: Anderson Silva

- Implied probability of Anderson Silva to win: 54.1% (implied probability calculator)

- Bet $100 on Anderson Silva to win $84.75

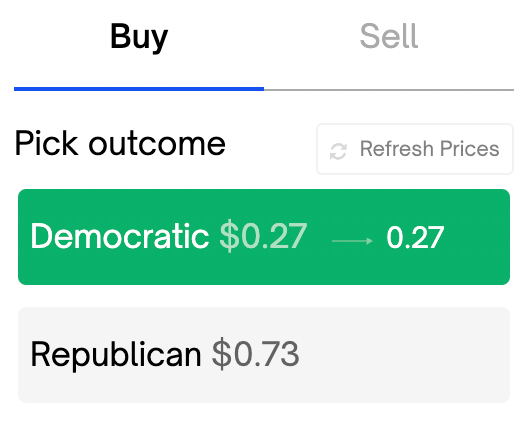

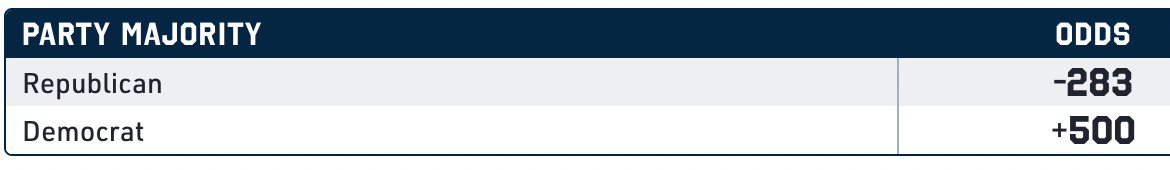

Which party will win the U.S. House in the 2022 elections?

Polymarket:

- Implied probability for Democrats to win: 27%

- Bet $100 on Democrats to win $270

Odds Checker:

- Implied probability for Democrats to win: 16.7%

- Bet $100 on Democrats to win $500

How to arbitrage bet

A naive approach would be to simply take advantage of the better odds. For example if you believe that Fanduel's team of oddsmakers is better at setting odds than Polymarket's market driven approach, you might also believe that FanDuel's implied probability is closer to what the actual outcome will be. In that case, you could simply bet on Polymarket whenever it offers underpriced odds relative to FanDuel (eg when Anderson Silva is the favorite on FanDuel but the underdog on Polymarket, make the bet on Polymarket).

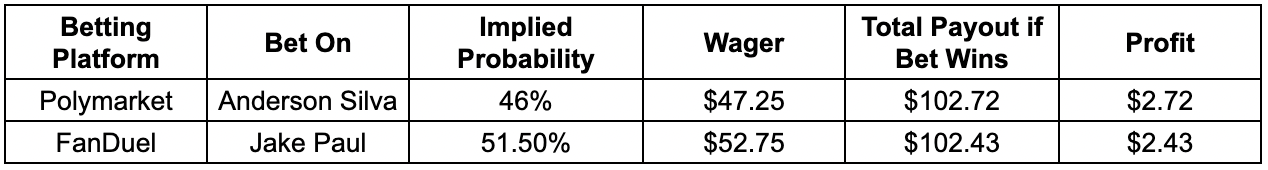

A more sophisticated approach involves placing opposite bets on both Polymarket and another platform with differing odds, resulting in a risk-free payout regardless of the outcome. If we use the Jake Paul vs Anderson Silva example, the following table shows how a splitting a wager of $100 will result in a profit regardless of who wins:

The basic idea for finding these opportunities involves identifying bets across books in which the summed implied probabilities is less than 100%. In our example using Polymarket and FanDuel, the summed probabilities add up to 97.5%. A more detailed explanation of this strategy is here and a tool for calculating how the wagers should be split can be found here. If someone were to have placed bets according to the table in our Paul vs Silva example, they would have profited a risk-free $2.43 given Jake Paul's victory this past weekend.

Note that while arbitraging Polymarket odds may seem promising, in practice it may be difficult if the trading volumes on specific markets are very small; large bets may cause the odds to change significantly and no longer be profitable.

The Power of Decoded Blockchain Data

A lot of useful info is stored on blockchains though much of it is only available through complex ETL jobs and decoding logic. If you would like to get your hands on more of this type of decoded data used in this post, not just for Polymarket but also for other contracts (e.g. Uniswap), check out Luabase.

Lastly if you would like a glimpse of what Luabase offers and want to play around with the data used in this post, check out this public notebook.